Breet vs Busha vs Roqqu vs Bitmama: Complete Comparison (2026)

TL;DR: Breet leads for speed and competitive rates with 99.7% success, Busha offers the most assets (70+) with SEC licensing and 24/7 human support, Roqqu provides the widest selection (120+ assets) plus crypto loans, while Bitmama focuses on global spending with physical cards. Choose Breet for fast cash-outs, Busha for regulatory trust, Roqqu for advanced features, or Bitmama for international payments.

Comparison Overview

| Criteria | ||||

|---|---|---|---|---|

| Pricing & Transparency Clarity of fee structure, competitiveness of rates, and absence of hidden charges | 9Single transparent rate with competitive pricing and clear fee structure | 7Live pricing for 70+ assets but no detailed tier structure disclosed | 6Competitive rates claimed but no transparent fee structure published | 7Low fees with zero deposit/withdrawal limits but specifics not detailed |

| Feature Set & Capabilities Breadth and depth of trading, payment, and financial tools offered | 8Strong core features with excellent business tools and USD wallets | 9Most comprehensive feature set with 70+ assets, earn, cards, and automation | 7Focused on spending with physical/virtual cards and global payments | 9Widest asset selection (120+) with unique crypto loans and payment links |

| Ease of Use & Speed Interface intuitiveness, transaction speed, and user experience quality | 9Fastest transactions (<5min) with intuitive interface and 99.7% success | 8User-friendly app with automated orders and instant funding options | 7Mobile-friendly for on-the-go trading with straightforward card features | 7Fast transfers with advanced charts but more complex for beginners |

| Customer Support Quality Availability, responsiveness, and effectiveness of customer service | 7Automated resolution systems with strong reliability but support details unclear | 924/7 human support with strong emphasis on customer service | 5Support quality not detailed; weakest documentation among competitors | 824/7 support with real-time SMS/email alerts for transaction updates |

| African Market Integration Local currency support, payment methods, and regional availability | 8Targeted Nigeria/Ghana support with all major banks and mobile money | 8Nigeria-focused with SEC licensing, 1M+ users, and strong local integration | 8Nigeria-based with 100+ country reach and NGN/GHS/KES support | 7Local bank withdrawals with remittances to 20+ countries including Africa |

| Business & Integration Tools APIs, business accounts, and tools for merchants and developers | 9Strongest developer/business focus with APIs, OTC, invoices, and VIP desk | 6Enterprise security standards but limited public business tool details | 5Global payment capabilities but minimal business tool documentation | 8Strong business payment tools and workflow integrations |

| Security & Reliability Regulatory compliance, security measures, uptime, and trust indicators | 899.7% success rate, non-P2P model, and recent platform upgrades | 9SEC-licensed with enterprise security, NDPR compliance, and 1M+ users | 7Licensed partners and security focus, but rebranding due to fraud confusion | 9ISO 27001, GDPR, NDPR audit (2024), cold storage, and 2FA |

Choosing the Right Crypto Platform in Nigeria

Nigeria's crypto ecosystem has matured significantly, with multiple platforms now offering fast trading, local currency support, and innovative payment features. Breet, Busha, Roqqu, and Bitmama represent four distinct approaches to crypto services in Africa, each with unique strengths.

Breet positions itself as the speed champion, promising crypto-to-cash conversions in under 5 minutes with a 99.7% transaction success rate. Its recent 3.0 Pro Max upgrade introduced single competitive rates across all transaction sizes, USD wallets, and enhanced business tools including developer APIs and an OTC desk for high-volume traders.

Busha takes the regulatory compliance route as Nigeria's SEC-licensed platform with over 1 million users. It offers the broadest feature set including 70+ tradable assets, automated trading tools (recurring buys, limit orders), optional earn/yield programs, and both virtual and physical debit cards with cashback.

Roqqu differentiates through sheer asset variety (120+ cryptocurrencies) and financial flexibility, offering crypto-backed loans, payment links for businesses, and zero-fee remittances to 20+ countries. Its ISO 27001 certification and NDPR audit appeal to security-conscious users.

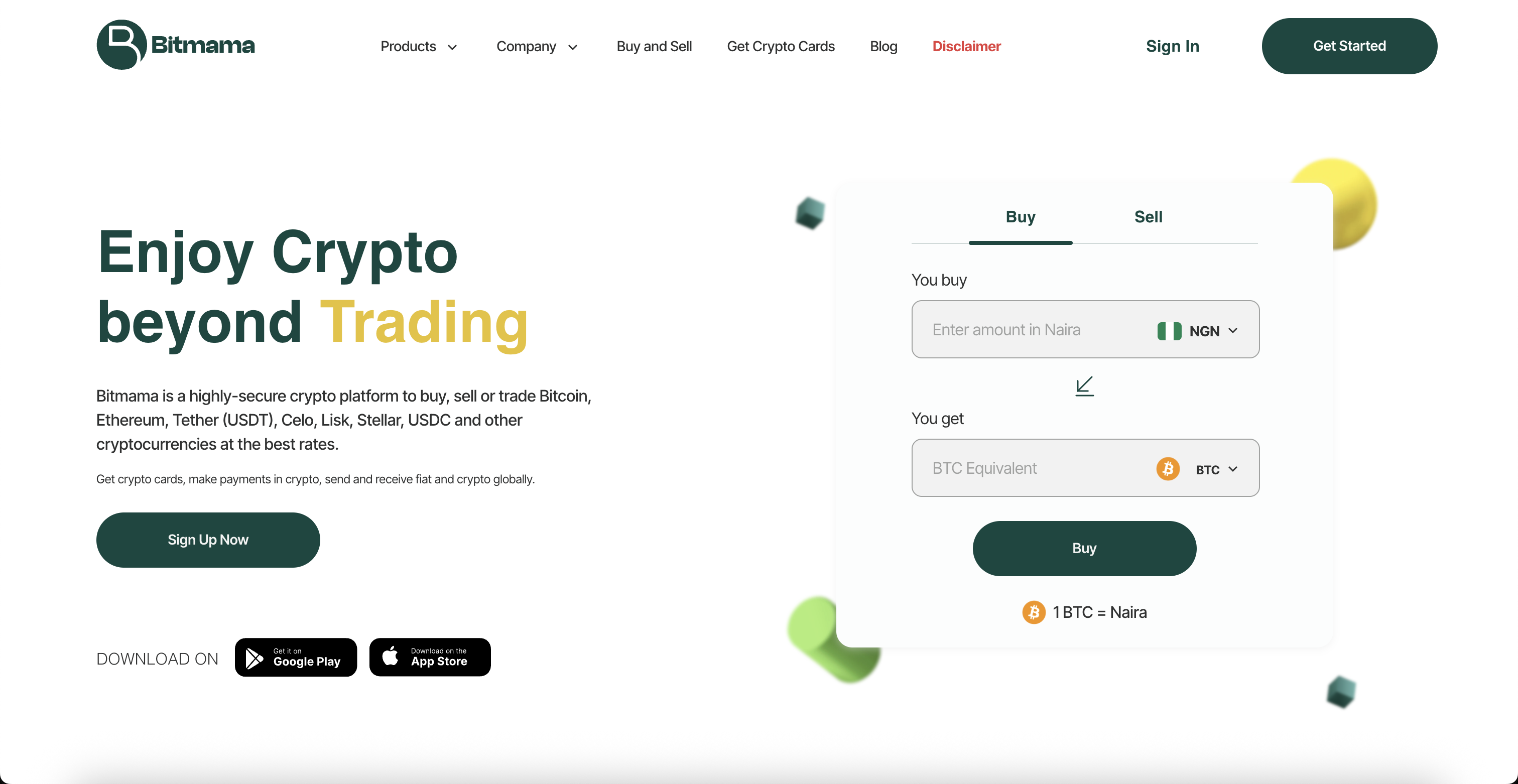

Bitmama focuses on making crypto spendable globally, with physical and virtual cards that work at POS terminals and ATMs, plus direct payment support for international services like Spotify and AWS. Available in 100+ countries, it serves users needing cross-border payment solutions.

This comparison examines pricing transparency, feature depth, ease of use, customer support quality, African market integration, business capabilities, and overall reliability to help you choose the platform that matches your specific crypto needs in 2026.

Detailed Analysis

Pricing & Transparency

Breet

9Breet's 3.0 upgrade introduced a single competitive rate across all transaction sizes, eliminating tiered confusion. Users report rates 7 NGN higher than competitors for BTC sales. The platform clearly defines transaction fees upfront, though specific percentages aren't publicly detailed. No hidden charges reported, and the non-P2P model removes counterparty risk pricing variability.

Busha

7Busha offers competitive live pricing across its extensive asset range but doesn't publicly detail fee tiers or percentages. The platform emphasizes transparency through real-time rates, but users must check in-app for actual costs. No major complaints about hidden fees, though the lack of published fee schedules reduces transparency compared to Breet.

Roqqu

7Roqqu markets itself as having low fees and zero deposit/withdrawal limits, which is attractive for high-volume traders. However, specific fee percentages and rate comparisons aren't publicly available. The zero-limit policy is a strong advantage, but the lack of detailed pricing information makes it harder to compare directly with competitors.

Bitmama

6Bitmama states it offers competitive rates but provides minimal public detail on fee structures or pricing tiers. Users must check the platform directly for current rates. The lack of pricing transparency is the weakest among the four platforms, though no major complaints about unfair pricing have surfaced in available data.

Feature Set & Capabilities

Breet

8Breet covers essential crypto operations (buy/sell/swap 12+ coins) plus practical additions like invoices, bill payments, OTC desk, and developer APIs. The 3.0 upgrade added USD wallets, internal transfers, price alerts, and a VIP dashboard for $5,000+ trades. Strongest for businesses needing API integration, though it lacks advanced trading features like limit orders.

Busha

9Busha offers the most complete package: 70+ tradable assets, recurring buys, limit orders, earn/yield programs (up to 18% with disclosed risks), collateral-based borrowing, USD accounts, virtual/physical debit cards with cashback, and bill payments. The automated trading features and wealth tools make it the most feature-rich platform, though earn returns aren't guaranteed.

Roqqu

9Roqqu leads in asset variety with 120+ cryptocurrencies, plus distinctive features like crypto-backed loans (collateralized stablecoins), payment links for businesses, virtual cards, savings options, and zero-fee remittances to 20+ countries. Advanced charts appeal to serious traders. The combination of breadth and financial flexibility is unmatched, though loan risks aren't fully detailed.

Bitmama

7Bitmama supports 8+ major cryptocurrencies with a clear focus on making crypto spendable: physical and virtual cards work at POS terminals and ATMs, direct payments to international services (Spotify, AWS, Google Workspace), and global send/receive in NGN/GHS/KES. The spending infrastructure is strongest here, but trading features and asset variety are more limited than competitors.

Ease of Use & Speed

Breet

9Breet excels in speed with average transaction completion under 5 minutes and a 99.7% success rate. Users praise the intuitive app interface and straightforward flows. The 3.0 upgrade added price alerts, rate calculators, and automated flagged transaction resolution, further streamlining the experience. Best-in-class for users prioritizing quick crypto-to-cash conversions.

Busha

8Busha's mobile app receives strong ratings for ease of use, with features like recurring buys and limit orders automating common tasks. Named local accounts enable instant funding, and the interface handles 70+ assets without overwhelming users. The comprehensive feature set is well-organized, though the breadth of options may have a steeper learning curve than Breet's focused approach.

Roqqu

7Roqqu emphasizes fast crypto transfers and reliable transaction processing, with advanced charts for experienced traders. The mobile app is functional, but the 120+ asset selection and multiple financial products (loans, savings, payment links) create more complexity. Better suited for users comfortable with crypto than absolute beginners seeking simplicity.

Bitmama

7Bitmama's mobile app supports buying/selling on the go with local currency support (NGN/GHS/KES). The card features are straightforward to use for spending. However, the platform provides less detail on transaction speeds and success rates compared to Breet, and the global payment features may require more setup than simple trading.

Customer Support Quality

Breet

7Breet's 3.0 upgrade introduced automated flagged transaction resolution, which should reduce support needs. The 99.7% success rate implies reliable operations that minimize customer issues. However, specific support availability (hours, channels, response times) isn't detailed in available data. The high success rate suggests good operational support, but human support quality is unverified.

Busha

9Busha explicitly highlights 24/7 human support as a key differentiator, backed by over 1 million users and strong app store ratings. The platform's SEC licensing and enterprise-grade security standards suggest serious commitment to customer protection. This is the strongest verified customer support offering among the four platforms.

Roqqu

8Roqqu offers 24/7 customer support complemented by real-time SMS and email notifications for transactions, providing proactive communication. The platform's ISO 27001 certification and high uptime claims suggest reliable service. Support quality appears strong, though specific response time guarantees aren't detailed.

Bitmama

5Bitmama provides minimal public information about customer support availability, channels, or quality. While the platform emphasizes security and transparency, the lack of support details is a notable gap. Users should verify support options directly before committing to the platform, especially for international payment issues that may require assistance.

African Market Integration

Breet

8Breet focuses specifically on Nigeria (NGN, all major banks) and Ghana (GHS, mobile money), with deep integration into local payment infrastructure. The platform is optimized for these two markets rather than spreading thin across many countries. Available on Android and iOS with localized features like Cedis support and mobile money integration.

Busha

8Busha is Nigeria-centric with SEC licensing, named local accounts for instant funding, and payouts to bank accounts or mobile wallets in NGN. The 1M+ user base demonstrates strong local adoption. The platform's regulatory compliance and local payment integration are excellent for Nigeria, though expansion to other African markets isn't clearly detailed.

Roqqu

7Roqqu supports local bank withdrawals and offers zero-fee remittances to 20+ countries, including African markets. The platform's multi-country approach provides broader regional coverage than Breet or Busha, though specific African country support and local currency options aren't fully detailed. Better for users needing cross-border African transactions.

Bitmama

8Bitmama operates from Nigeria with support for NGN, GHS, and KES, plus availability in 100+ countries globally. The platform's strength is connecting African users to global payment systems rather than deep local integration. Good for users needing both African and international reach, though local payment method variety may be more limited than Busha.

Business & Integration Tools

Breet

9Breet leads in business tools with developer APIs for payment integration, an OTC desk for high-volume trades, invoice generation for accepting crypto payments, and a VIP dashboard for $5,000+ traders. The platform is clearly designed with business users and developers in mind, offering the most comprehensive B2B toolkit among the four platforms.

Busha

6Busha mentions enterprise-grade security standards, suggesting business-level capabilities, but doesn't publicly detail specific APIs, merchant tools, or business account features. The platform's scale (1M+ users) implies some business support, but it appears more consumer-focused than Breet. Business users should inquire directly about available tools.

Roqqu

8Roqqu offers business payment tools, payment links for accepting funds, and integration options for company finance workflows. The platform's features suggest solid B2B capabilities, though less developer-focused than Breet's API approach. Good for businesses needing payment acceptance and workflow integration rather than deep technical integration.

Bitmama

5Bitmama's global payment features (paying for Spotify, AWS, etc.) imply some business utility, but the platform doesn't publicly detail APIs, merchant tools, or business-specific features. The focus appears consumer-oriented with business use as a secondary benefit. Companies needing dedicated business tools should look to Breet or Roqqu.

Security & Reliability

Breet

8Breet's 99.7% transaction success rate is the highest verified metric among competitors. The non-P2P model eliminates counterparty risks inherent in peer-to-peer platforms. The recent 3.0 Pro Max upgrade demonstrates active development and platform investment. However, specific security certifications (ISO, etc.) aren't detailed, and regulatory licensing status is unclear.

Busha

9Busha has the strongest regulatory position with SEC licensing in Nigeria, enterprise-grade security standards, and NDPR-aligned data protection. The 1M+ user base and strong app store ratings demonstrate proven reliability at scale. The regulatory compliance makes it the safest choice for risk-averse users prioritizing legal protection and institutional-grade security.

Roqqu

9Roqqu matches Busha in security credentials with ISO 27001 certification, GDPR compliance, and a 2024 NDPR audit. The platform uses cold storage for assets and mandatory 2FA for accounts. High uptime claims and 24/7 monitoring add to reliability. The comprehensive security certifications make it ideal for security-conscious users, though it lacks Busha's SEC regulatory licensing.

Bitmama

7Bitmama operates via partnerships with licensed transmitters where required and emphasizes security and transparency. However, the company is rebranding to avoid confusion with an unrelated fraud case involving someone who used the "Bitmama" name. While the platform itself isn't implicated, the rebranding need suggests brand trust challenges. Security measures are mentioned but not detailed like Roqqu's certifications.

Verdict

For speed and competitive rates: Breet wins with its <5-minute settlements, 99.7% success rate, and transparent single-rate pricing. The recent 3.0 upgrade makes it ideal for users who prioritize fast crypto-to-cash conversions in Nigeria and Ghana.

For regulatory trust and comprehensive features: Busha is the safest bet with SEC licensing, 1M+ users, 24/7 human support, and the most complete feature set including earn programs and cards. Best for users wanting a one-stop platform with strong compliance.

For advanced traders and asset variety: Roqqu offers 120+ assets, crypto loans, and sophisticated business tools. Choose this if you need maximum trading options and financial flexibility beyond basic buy/sell.

For global spending and international payments: Bitmama excels with physical cards, POS/ATM access, and direct payment to international services. Ideal for users who want to spend crypto like traditional money across 100+ countries.

Most Nigerian users will find Breet or Busha sufficient for everyday needs, while Roqqu and Bitmama serve more specialized use cases. All four are legitimate, but verify current fees and features directly on their platforms as crypto services evolve rapidly.

Frequently Asked Questions

Which platform offers the fastest crypto-to-cash conversions in Nigeria?

▾

Breet leads in speed with average transaction completion under 5 minutes and a 99.7% success rate. The platform is specifically optimized for fast crypto-to-cash conversions in Nigeria (NGN) and Ghana (GHS), with payouts to all major banks and mobile money. Busha also offers instant funding and fast payouts, but Breet's verified speed metrics make it the clear winner for users prioritizing transaction speed.

Which platform is safest for beginners concerned about security and regulation?

▾

Busha is the safest choice with SEC licensing in Nigeria, enterprise-grade security, NDPR compliance, and 24/7 human support. The regulatory oversight and 1M+ user base provide strong trust indicators. Roqqu matches Busha in security certifications (ISO 27001, GDPR, NDPR audit) but lacks SEC licensing. For absolute beginners prioritizing regulatory protection, Busha's SEC license makes it the most secure option.

Can I use these platforms to pay for international services like Netflix or AWS?

▾

Bitmama is specifically designed for this, with direct payment support for international services like Spotify, Google Workspace, and AWS, plus physical/virtual cards that work globally at POS terminals and ATMs. Busha and Roqqu also offer virtual cards for online payments, but Bitmama's focus on global spending makes it the strongest choice for international payment needs across 100+ countries.

Which platform offers the most cryptocurrencies to trade?

▾

Roqqu leads with 120+ tradable assets, significantly more than Busha's 70+ assets, Breet's 12+ coins, or Bitmama's 8+ cryptocurrencies. If you need access to a wide variety of altcoins and tokens beyond major assets like BTC, ETH, and USDT, Roqqu provides the most extensive selection. However, for most users focused on major cryptocurrencies, Breet or Busha's selections are sufficient.

Do these platforms charge fees for deposits and withdrawals?

▾

Fee structures vary: Roqqu explicitly advertises zero deposit and withdrawal limits with low fees, making it attractive for high-volume traders. Breet uses a single transparent rate across all transaction sizes with defined fees, though specific percentages aren't publicly detailed. Busha and Bitmama don't publicly detail their fee structures, so users should check in-app for current rates. Always verify current fees directly on each platform before trading.

Some details in this comparison could not be fully verified. Please double-check the following before making decisions:

- Specific fee percentages for Breet, Busha, Roqqu, and Bitmama are not publicly detailed in available sources

- Exact regulatory licensing status for Breet, Roqqu, and Bitmama beyond Busha's confirmed SEC license

- Current status of Bitmama's announced rebranding and new brand name

- Detailed customer support response times and SLA guarantees for all platforms

- Specific earn/yield rates and risk disclosures for Busha's wealth products

- Loan terms, collateral ratios, and liquidation policies for Roqqu's crypto loans

- Whether pricing and features have changed since the research data was collected (some data may be pre-2026)

- Availability of Roqqu and Bitmama in specific African countries beyond Nigeria

- API documentation quality and developer support resources for Breet's developer tools